A recent market investigation by Germany’s financial regulator, BaFin, revealed that a significant majority of retail investors trading turbo certificates incurred substantial losses. Covering January 2019 to December 2023, the study found that 74.2% of these investors lost money, with average losses of €6,358 per losing investor. Total losses exceeded €3.4 billion during this five-year period.

Turbo certificates are leveraged derivative products similar to contracts for difference (CFDs), another popular but high-risk instrument among retail investors. Both allow for leveraged exposure to underlying assets but can lead to rapid and total capital loss.

Due to their complexity and risks, CFDs have faced EU regulatory restrictions. BaFin’s findings may prompt renewed scrutiny of turbo certificates, which are also marketed under various names such as “Knock-Out Options,” “Mini-Futures,” or “Wave XXL Certificates,” potentially obscuring the associated risks.

High-Risk Trading Hits German Retail Investors

These certificates enable investors to amplify exposure to price movements of assets like stocks, indices, or currencies. They include a knock-out threshold: if the asset price reaches this level, the certificate expires immediately and becomes worthless. While gains can be magnified, losses can quickly wipe out the entire investment.

The BaFin analysis examined approximately 113 million transactions by 543,000 retail investors, based on data reported under Article 26 of the EU’s Markets in Financial Instruments Regulation (MiFIR). It focused on small investors with German citizenship, excluding trades via intermediaries outside the EU or by non-German residents.

You may find it interesting at FinanceMagnates.com: Crypto Young Investors: BaFin Study Reveals over 50% Trust Social Media and Finfluencers.

German Intermediaries Handle Most Turbo Trades

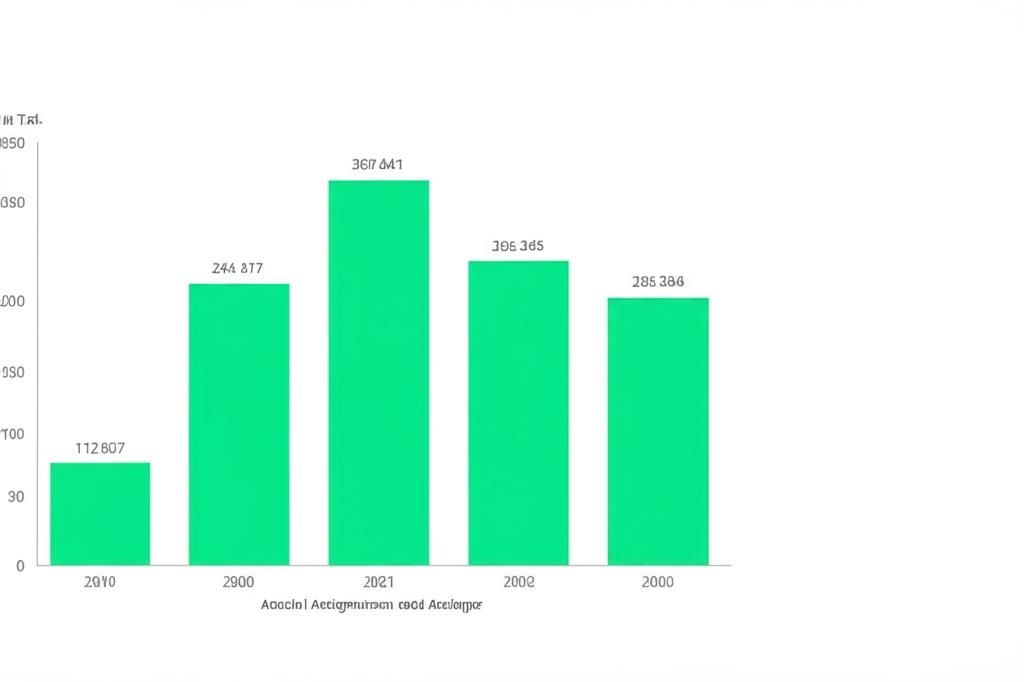

Over five years, the number of investors and transactions more than doubled. In 2023, about 231,000 small investors traded turbo certificates in Germany, an increase of around 110% since 2019 despite being slightly below the 2021 peak. Investors placed over 62 million purchase orders averaging €3,003 each, with a combined purchase volume near €195 billion.

The market is highly concentrated. Among 20 active issuers, the top five accounted for over 75% of transactions. Similarly, the top five of 1,294 intermediaries handled more than three-quarters of the volume. Most intermediaries (1,147) were based in Germany.

Frequent Turbo Traders Suffer Higher Losses

BaFin’s evaluation also highlighted a correlation between trading frequency and losses. Investors with 1–10 trades had a 70% loss rate, rising to 76% for 10–100 trades, 83% for 100–500 trades, and 91% for over 1,000 trades. Around 12% of investors lost more than €10,000, while only 2% earned profits of similar size.

Like any other industry with a high net worth, the financial services industry is tightly regulated to help curb illicit behavior and manipulation. Each asset class has its own set of protocols put in place to combat their respective forms of abuse.In the foreign exchange space, regulation is assumed by authorities in multiple jurisdictions, though ultimately lacking a binding international order. Who are the Industry’s Leading Regulators?Regulators such as the UK’s Financial Conduct Authority (FCA) and the US Commodity Futures Trading Commission (CFTC) are just a few of the many regulators who oversee the Forex industry.