Ripple has secured its first blockchain-enabled payments clients in the United Arab Emirates following its regulatory license from the Dubai Financial Services Authority (DFSA), marking a significant expansion in one of the world’s largest cross-border payment hubs.

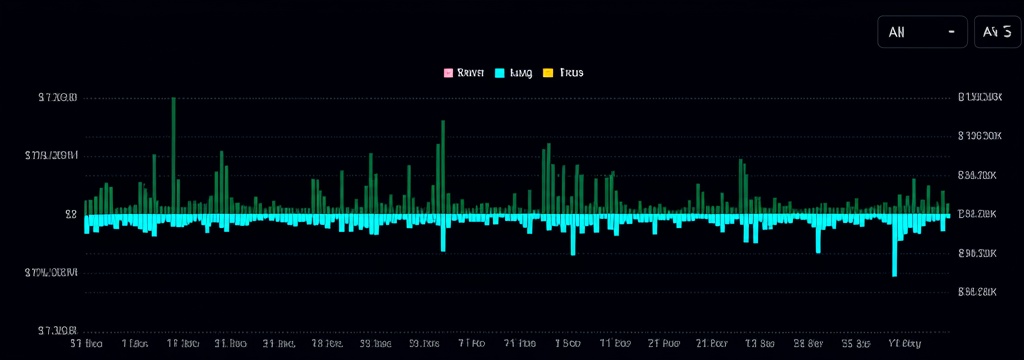

However, the price of XRP has been highly volatile, sliding nearly 6% during Monday’s session on May 19, 2025. At the moment, a single XRP is trading for under $2.30. Let’s explore why XRP price is down today and what triggered the sell-off.

Ripple Expands UAE Presence with First Blockchain Payment Clients

The digital asset infrastructure provider announced today (Monday) that Zand Bank and Mamo will utilize Ripple Payments, the company’s blockchain-enabled cross-border payment solution, to facilitate faster and more transparent international transactions.

This development comes two months after Ripple became the first blockchain-enabled payments provider to receive a license from the DFSA in March 2025, allowing the company to manage end-to-end payments.

“Securing our DFSA license enables Ripple to better serve the demand for solutions to the inefficiencies of traditional cross-border payments in one of the world’s largest cross-border payments hubs,” said Reece Merrick, Managing Director for Middle East and Africa at Ripple.

Strategic Ripple Partnerships in a Growing Market

The UAE partnerships reflect growing regional interest in blockchain-based payment solutions. According to Ripple’s 2025 New Value Report, 64% of finance leaders in the Middle East and Africa region view faster payments and settlement times as the primary motivation for incorporating blockchain technology into cross-border payment flows.

Zand Bank, which holds a full banking license in the UAE, will integrate Ripple’s technology as part of its digital asset services. “Our collaboration with Ripple highlights our commitment to empowering global payment solutions through blockchain technology,” said Chirag Sampat, Head of Treasury and Markets at Zand Bank.

Sampat added that Zand Bank plans to launch an AED-backed stablecoin to enhance transactions in the digital economy.

Mamo, a payment service provider, will use Ripple’s technology to support business growth in the UAE. “Our partnership with Ripple is a big step forward. It allows us to offer faster, more reliable cross-border payments for both businesses and consumers,” said Imad Gharazeddine, CEO and co-founder of Mamo.

XRP News: Global Expansion and Market Presence

Ripple Payments now operates in multiple jurisdictions including Dubai, the United States, Brazil, Mexico, Australia, and Switzerland. The company reports processing more than $70 billion in volume across 90+ payout markets, representing more than 90% coverage of daily foreign exchange markets.

The company holds over 60 regulatory licenses and registrations globally, positioning it to provide tokenization, storage, exchange, and movement of digital assets for financial institutions.

Why Is XRP Price Down Today? Selloff Amid Broader Crypto Volatility

While Ripple expands its institutional partnerships, its associated cryptocurrency XRP has experienced price volatility. XRP is currently trading at $2.29, down nearly 5% over the past 24 hours amid broader cryptocurrency market turbulence.

“We are in a period of high uncertainty, where even traditional financial markets have become highly sentiment-driven. In crypto, the situation is even more fragile; liquidity has been largely withdrawn, leaving the market thin and highly susceptible to sharp moves,” said Dr. Kirill Kretov, market analyst at CoinPanel.

How Low (Or High) Can XRP Price Go? XRP USDT Technical Analysis

My technical analysis shows that XRP has stalled at local support near $2.29, a level tested many times since early 2025: first as support in January, February, and March, then several times as resistance through April and early May. The zone is again acting as support. If it gives way, XRP could slip back into the bearish regression channel it has followed for the past five months.

| Price Level | Role | Basis |

|---|---|---|

| $2.29 | Support | Repeatedly tested since Jan 2025; currently holding |

| $2.00 | Support | Round-number psychological level |

| $1.89 | Support | Aligns with March lows |

| $1.80 | Support | April bottom |

| $2.47 | Resistance | Late-March local high |

| $2.65 | Resistance | Late-March peak; served as resistance in late 2024 |

| $3.00 | Resistance | Round-number target |

| $3.40 | Resistance | January 2025 high |

Despite these short-term fluctuations, institutional adoption of blockchain payment solutions continues to advance, with Ripple’s UAE expansion representing a notable development in the integration of digital asset technology into traditional financial systems.

“Anything below a 5% move should be treated as noise. Learn to extract profits from this volatility, because only when the majority of market participants adjust to this environment will the market structure begin to change,” Kretov suggests market participants adapt to the current more volatile reality.

XRP News FAQ

What is the prediction of XRP in 2025?

Analyst targets for year-end 2025 span a wide range:

In short, consensus leans toward low-single-digit to mid-single-digit prices, with double-digit targets requiring multiple favorable catalysts that are not yet certain.

Will XRP reach $100?

Highly unlikely in the current cycle. At $100 per coin, XRP’s market capitalization would exceed $5 trillion—larger than Apple and Microsoft combined—without any mechanism to retire or lock up the roughly 100 billion-token supply. Most professional forecasters therefore dismiss a three-digit print before 2030.

Will XRP reach $500?

A $500 XRP implies a capitalization above $25 trillion, more than global M1 money supply. No credible analyst or institution projects such a level within the foreseeable future. It would require wholesale replacement of legacy payment rails worldwide and an unprecedented contraction of free-floating supply—conditions that remain theoretical at best.

Could XRP reach $20?

A jump to $20 (roughly an eight-fold gain) sits at the upper edge of bullish but still numerically plausible scenarios. Traders who track Elliott-Wave patterns and some institutional-adoption models argue it could happen late 2025 or in 2026 if:

While far from the base case, a $15–$20 print is considered attainable under an aligned set of positive catalysts and would put XRP’s market value near $1–$2 trillion, well below Bitcoin’s 2021 peak but significantly above today.